Pre-Qualified vs. Pre-Approved: What’s the Difference?

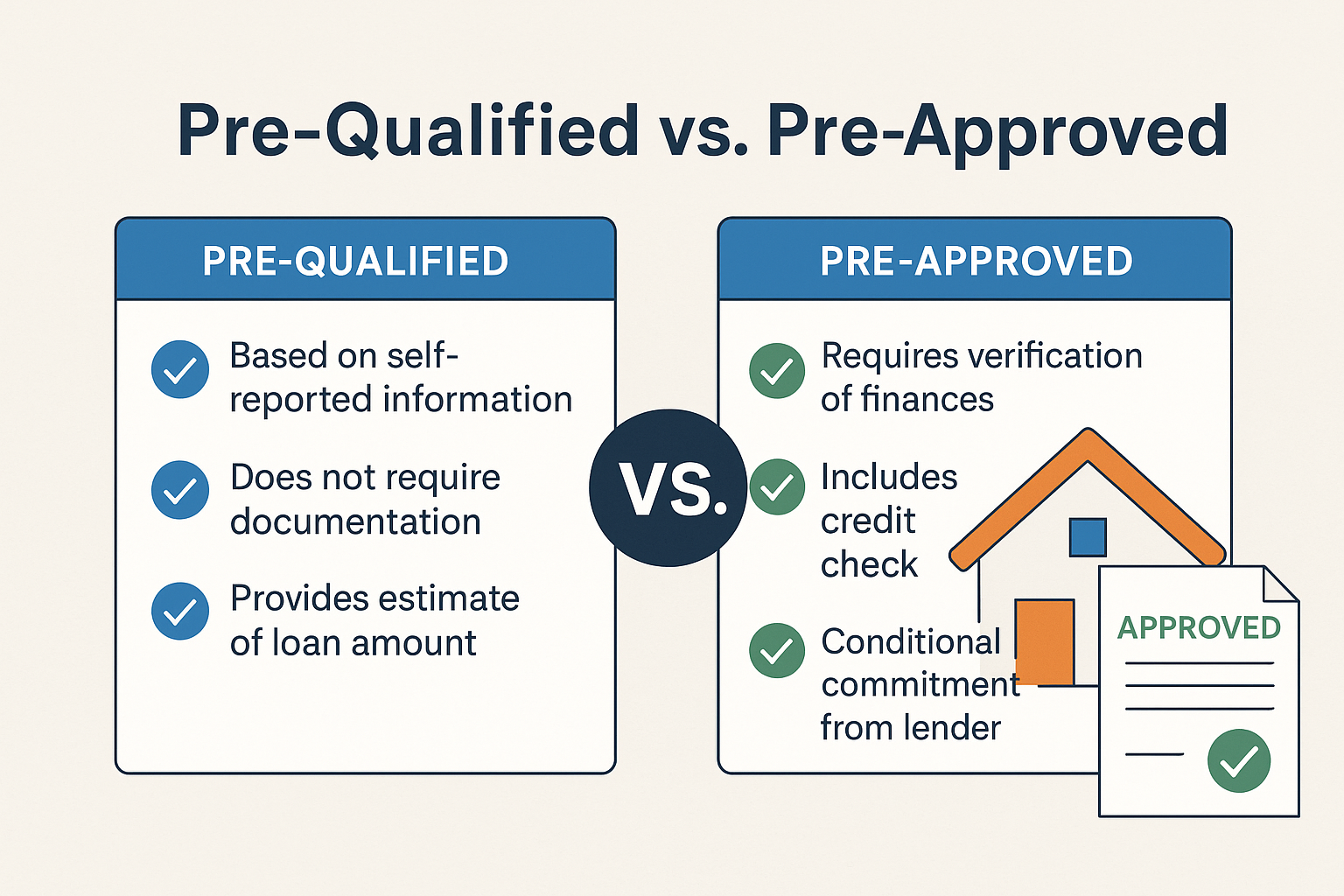

When you’re preparing to buy a home, you’ll likely come across the terms “pre-qualified” and “pre-approved”. While these terms are often used interchangeably, they represent two distinct steps in the mortgage process. Understanding the difference between the two can help you navigate the homebuying journey with confidence and efficiency.

Pre-Qualified vs. Pre-Approved: A Quick Comparison

Pre-qualification is typically the first, more informal step in the mortgage process. It’s based largely on self-reported financial data, such as your income, debts, and assets. In contrast, pre-approval involves a more in-depth review of your finances, including document verification and a credit check. Both are optional, but each serves a different purpose—and can give you an edge in a competitive market.

What Does Pre-Qualified Mean?

Mortgage pre-qualification is an early indication that you may meet a lender’s basic criteria for a loan. You’ll provide estimates of your income, debt, assets, and other financial details—often through a short conversation or online form.

Because this step doesn’t involve document verification or a credit check, the resulting estimate is a rough guide. The lender may issue a pre-qualification letter indicating the loan amount and types of loans you might be eligible for. However, this letter is not a guarantee and doesn’t carry the same weight as a pre-approval when negotiating with sellers.

According to MaisonLink’s 2025 Homebuyer Insights, about 27% of prospective buyers start their journey with a pre-qualification to better understand their price range and eligibility before committing to the more involved pre-approval process.

Pre-qualification is a helpful tool for those still exploring their options or just beginning their search. However, it’s important to remember that the accuracy of the estimate depends entirely on the information you provide.

What Does Pre-Approved Mean?

Mortgage pre-approval is a more serious and formal step that involves a conditional commitment from a lender. To get pre-approved, you must submit official documents such as:

- Recent pay stubs

- W-2 forms or tax returns

- Bank statements

- Government-issued ID

The lender will also perform a credit check, which may appear as a soft or hard inquiry, depending on their procedures.

Once you’re pre-approved, you’ll receive a pre-approval letter that outlines:

- The maximum loan amount

- The types of loans you qualify for (e.g., Conventional, FHA, VA)

- Estimated interest rates and annual percentage rates (APR)

- The validity period of the pre-approval

This letter demonstrates to sellers that you are a serious, financially qualified buyer. In fact, MaisonLink’s 2025 Consumer Housing Report found that 85% of home sellers prefer offers from pre-approved buyers, as it signals a lower risk of financing issues and a higher chance of a successful closing.

It’s important to note that pre-approval does not equal final loan approval. After making an offer on a home, you’ll still need to complete a formal loan application and go through the underwriting process.

Why Does It Matter?

Whether you choose to get pre-qualified or pre-approved, taking one of these steps before house hunting gives you a clearer picture of what you can afford. More importantly, a pre-approval letter can significantly strengthen your offer, helping you stand out in a competitive market.

While both are useful tools, if you’re ready to begin making offers or want to move quickly once you find the right property, getting pre-approved is highly recommended.

Final Thoughts

In summary:

Feature

Based on Self-Reported Info

Requires Documentation

Involves Credit Check

Provides Estimated Loan Amount

Strengthens Home Offer

Conditional Loan Commitment

Pre-Qualification

✅

❌

❌

✅

⚠️ (limited)

❌

Pre-Approval

❌

✅

✅

✅

✅

✅

Getting pre-qualified is a helpful first step, but pre-approval offers a more powerful position in the homebuying process. Partner with a reputable lender early on—MaisonLink recommends getting pre-approved before starting serious home shopping, to ensure you’re ready to make a competitive offer when you find the right home.

Difference Between Pre-Approved and Pre-Qualified

Pre-qualification is a helpful first step that can prepare you to move forward in the homebuying process. It gives you a general idea of what loan amount you may qualify for, helping you establish a realistic budget as you begin your home search. However, it’s based on self-reported financial information and does not involve formal verification.

In contrast, pre-approval offers a more definitive and detailed assessment of your financial standing. It requires documentation such as income verification, bank statements, and a credit check. With this information, lenders can provide a conditional loan commitment, giving you a clearer picture of your borrowing power.

A pre-approval letter can also make you more competitive in the market. It shows sellers that you are a serious and financially qualified buyer, ready to move forward with an offer. According to MaisonLink’s 2025 Housing Report, sellers are significantly more likely to consider offers backed by a pre-approval over those without.

Here are a few additional key differences between pre-qualification and pre-approval:

Feature

Based on Self-Reported Info

Requires Financial Documents

Includes Credit Check

Offers Budget Estimate

Strengthens Offer to Seller

Conditional Loan Commitment

Pre-Qualification

✅

❌

❌

✅

⚠️ (limited)

❌

Pre-Approval

❌

✅

✅

✅

✅

✅

Both steps can be beneficial, but if you’re ready to start making offers, pre-approval is the stronger and more credible option.

FAQs About Pre-Qualification vs. Pre-Approval

Why should I get pre-qualified instead of pre-approved?

Getting pre-qualified can be a great first step, especially for first-time homebuyers or those just beginning to explore the idea of purchasing a home. Since most pre-qualifications do not involve a hard credit inquiry, your credit score remains unaffected if you choose to delay your home search. Pre-qualification can also help you identify which lenders you may prefer to work with when you’re ready to move forward.

Regardless of whether you choose pre-qualification or pre-approval, you will still need to have an accepted offer, complete a full loan application, and enter into a purchase agreement before your loan can be fully underwritten and approved by your lender.

Why wait to get pre-approved?

Many buyers begin with a pre-qualification to get a rough estimate of their borrowing capacity, and move to pre-approval when they are ready to start seriously shopping and making offers. One key reason for timing your pre-approval is that these letters are typically valid for about 45 days. After this period, you may need to renew your pre-approval, especially if your financial situation changes—such as acquiring new debt or opening a credit account, which can impact your credit score.

It’s also important to note that pre-approvals require a credit check. Depending on the lender, this could be a soft or hard inquiry. Multiple mortgage-related inquiries within a 45-day window are generally treated as a single inquiry by credit scoring models, minimizing their impact. If your pre-approval expires while you’re still actively house hunting, your lender can guide you through the renewal process.

Are pre-qualification and pre-approval the same thing?

No, they are not the same. While both can help estimate how much you may be able to borrow, pre-qualification is based on self-reported information and offers a general financial picture, whereas pre-approval involves document verification, a credit check, and a conditional commitment from a lender. Both can demonstrate to real estate agents and sellers that you are a serious buyer, but pre-approval holds greater credibility.

Which is better: pre-approval or pre-qualification?

In most cases, pre-approval is the stronger option. It provides a verified, conditional loan offer from a lender and indicates you’re ready to make a competitive bid on a property. If you’re actively pursuing a home purchase and have a clear timeline, pre-approval gives you more leverage in negotiations. On the other hand, if you’re just beginning your search or unsure of your budget, a pre-qualification can help provide insight into your potential loan eligibility.

Do I have to borrow the full amount I’m pre-approved for?

Not at all. You are not obligated to purchase a home at the top of your pre-approved price range. In fact, it’s wise to consider your personal financial goals, monthly expenses, and lifestyle preferences before deciding how much of your approved loan amount to use. MaisonLink recommends using affordability tools or consulting with a financial advisor to determine a comfortable and sustainable housing budget.

Do I need a pre-qualification letter to view homes or work with a real estate agent?

While it’s not a strict requirement, many real estate agents prefer to see at least a pre-qualification letter before committing time and resources to home showings. Having a pre-qualification letter can also help you avoid looking at homes that exceed your financial comfort zone.

Do I need a pre-approval letter to make an offer?

You can technically make an offer without a pre-approval letter, but it’s strongly recommended to include one, especially in competitive markets. A pre-approval letter reassures sellers that you are financially qualified and ready to proceed, giving your offer greater credibility and increasing your chances of acceptance.